The Internal Revenue Service recently issued the 2017 optional standard mileage rates, which are used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes.

Beginning January 1, 2017 standard mileage rates for the use of cars, vans, pickup trucks, or panel trucks will lower to 53.5 cents per business miles driven, down from 54 cents in 2016. Medical and moving rates dipped from 19 cents in 2016 down to 17 cents in 2017, while charitable organization rates remain at 14 cents per mile.

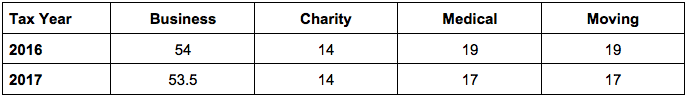

The table below shows which rates apply to the respective year’s travel.

2016 and 2017 Standard Mileage Deduction Rates Table Image

This is the second straight year that the mileage rates have been reduced.

The standard mileage rate for business is based on an annual study of the fixed and variable costs of operating an automobile. Declining fuel prices are one factor that has led to the reduction in the rates.

The IRS does give taxpayers the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates. A taxpayer may not use the business standard mileage rate for a vehicle after using any depreciation method under the Modified Accelerated Cost recovery System (MACRS), or after claiming a Section 179 deduction for that vehicle.

For more information on the IRS lowering the 2017 mileage rates, see this IRS Article.